I Couldn’t Care Less

Curating the Silence around Private Equity Managed Nursing Homes

Charlotte Laurence

December 29, 2024

On December 29, 2022, A.P., an elderly patient, had been living in Buffalo Center Nursing home in Westchester County, New York for three weeks. His right arm was amputated due to diabetes and his left arm paralyzed due to a stroke. While in Buffalo Center, A.P. was not given his pain or diabetes medications, did not have his amputation bandages changed, and lost twenty pounds from starvation because he could not feed himself. Although staff would deliver trays and drinks, the home did not provide staff to help him eat it.

In July 2022, a visitor found her mother, B.M., a six-month resident of Martine Center in Westchester, on the floor in great discomfort. B.M.’s daughter noticed a hole where her mother’s colostomy bag should have been, and saw exposed intestines with the adjacent skin covered in feces. Staff eventually admitted that no one had checked on B.M. in days. During another visit in October 2022, B.M.’s daughter found her mother’s intestinal wound dressing around the colostomy bag soaked in feces. Staff had visited her that day, but instead of cleaning and dressing her wound, they opened the window to the room because it smelled, leaving B.M. in pain, and covered in flies.

Staff had visited her that day, but instead of cleaning and dressing her wound, they opened the window to the room because it smelled, leaving B.M. in pain, and covered in flies.

These stories are just two of hundreds in the filings of New York Attorney General Letitia James, in support of her office’s lawsuit against owners, operators, and landlords of four nursing homes, for years of persistent fraud and illegal misuse of more than $83 million in taxpayer money. AG James alleges this resulted in significant resident neglect, harm, and humiliation. Affected residents were forced to sit for hours in their urine and feces, experienced severe dehydration, malnutrition, and increased risk of death, developed infections and sepsis from untreated bed sores and inconsistent wound care, sustained life-changing injuries from falls, and died.

Under New York law, owners of nursing homes have a “special obligation” to ensure the highest possible quality of life for residents, and to sufficiently staff the facility to provide adequate care to all residents. However, this lawsuit paints a picture of a subset of nursing homes which leaves this obligation in the dust. Owners, operators, and landlords of the nursing homes and related companies wove a complicated web of fraudulent financial schemes to siphon money from the nursing homes, while they ignored and violated numerous laws designed to protect nursing home residents, resulting in preventable neglect and harm of vulnerable New Yorkers.

Attorney General (AG) James’ complaint meticulously tracked how Private Equity (PE) funds which owned four nursing homes engaged in multiple fraudulent schemes to divert government funds from the nursing homes, including collusive real estate arrangements, unnecessary and exorbitant loans with inflated interest rates, phony fees paid to companies that they and their family members owned, and paying themselves inflated salaries for work that was not performed.

This lawsuit came shortly after her office successfully sued NYPPEX Holdings, a PE firm which owned multiple nursing homes for “utiliz[ing] [funds belonging to the individual nursing homes] to pay partners exorbitant NYPPEX annual salaries, totaling approximately $6 million, as well as to pay the salaries of his staff.” The presiding judge found that the evidence “revealed a shocking level of self-dealing, breaches of fiduciary duty, misappropriation of enormous sums of ACP capital, and outright fraud.” Building on the momentum of the NYPPEX suit, AG James’ ongoing suit is the fourth – and largest – enforcement action that the New York AG’s office has taken in the past year to stop fraud in nursing homes owned by PE firms.

The evidence revealed a shocking level of self-dealing, breaches of fiduciary duty, misappropriation of enormous sums of ACP capital, and outright fraud.

While AG James is now aggressively pursuing PE-owned nursing home abuse, the problem has existed for decades. This battery of suits is indicative of a broader and growing political will to deal with an issue that corporate law and politics have allowed – quite literally – to fester for decades: how PE firms have been allowed to sap nursing homes of their capacity to preserve the lives entrusted to them. This article will explore the legal mechanisms sustaining this cycle of neglect and death, and the political narratives which have hitherto insulated it.

None of This Is New

PE-owned nursing home abuse stories are not new. In 2004, the New York Times (NYT) generated much fanfare with its coverage of one Florida woman’s untimely death due to mistreatment at her nursing home. The article detailed how Alice Garcia, an eighty-one year old woman suffering from Alzheimer’s disease, moved into Habana, a nursing home in Florida. After five months there, Garcia’s daughter discovered that one of Garcia’s bed sores became infected by feces, causing Garcia’s death a week later.

The NYT covered Garcia’s story in such depth not, I argue, because of an uncommonly negligent way the home treated Garcia, but because Garcia’s daughter was uncommonly successful in suing the home. For decades, it has been notoriously difficult to sue PE-owned nursing homes for abuse or neglect of residents.

In 2007, one plaintiff’s lawyer who worked with nursing home abuse cases estimated that about 70% of lawyers who once sued homes stopped because the cases became too expensive or difficult to ascertain who to sue. Where private efforts have traditionally failed, government efforts at regulation have not fared much better. Regulators often contend they have been stymied. For example, Florida’s Agency for Health Care Administration has named Habana, and thirty-four other homes owned by the PE fund, Formation, as among the state’s worst in categories like “nutrition and hydration” and “restraints and abuse.”

While those homes have been individually cited for violations of safety codes, there were no chainwide investigations or fines because regulators were unaware that all the facilities were owned and operated by a common group. For individuals seeking to sue the homes, and for government agencies seeking to regulate them, complex corporate structures make the necessary scrutiny difficult.

Retirement Living list of nursing homes in Tampa, FL

Patients and their families facing the realities of nursing home neglect and abuse have struggled to answer two questions: why were their loved ones seemingly preordained to suffer, and whom should they hold accountable? To expand upon the first question, as one rotating nurse practitioner at several privately owned Florida homes attested, patients in PE-owned nursing homes have found it difficult to understand why their nursing homes are so dangerously underequipped to meet their needs. After all, nursing homes are seemingly well-funded enough to avoid the above descriptions of abuse and neglect. The U.S. nursing care market was valued at $475.15 billion in 2023 and is expected to reach $692.19 billion by 2029. State laws are seemingly designed to encourage the bulk of that money to be reinvested in patient care, not to fall into the pockets of an owners’ board of directors.

Some states, like New Jersey, mandate that at least 90 percent of revenue is spent on patient care. This equitable division of revenue into profit and care is buttressed by the Affordable Care Act (ACA), which directs health insurers, by way of analogy, to spend at least 80 cents of every dollar in premiums to pay for beneficiaries’ health care needs.

And yet, low staffing and equipment levels ensure patient care atrocities persist. A smattering of non-profit driven studies show how negatively correlated the care available in PE-owned nursing homes is, versus in non-PE owned facilities. However, they did not speculate as to why this is. This hitherto lack of publicly available information on nursing home ownership and management is made more surprising by the fact that these issues are not confined to any one state. Indeed, about 70% of the nation’s roughly 15,000 nursing homes operate as for-profit businesses, and about 11 percent are estimated to be owned by PE firms.

Patients and their families found it equally frustrating to determine whom they could hold accountable for the abuse of their loved ones.

Setting aside this question of why these homes could not meet patient needs, patients and their families found it equally frustrating to determine whom they could hold accountable for the abuse of their loved ones. Additional NYT coverage of Garcia’s case revealed her daughter initially could not determine which, among fifteen owners of Habana nursing home, were ultimately legally responsible for her mother’s care.

Ten days after the aforementioned NYT article was published, Senator Charles Grassley (R-Iowa) requested that the Government Accountability Office (GAO) investigate the scope and impact of private equity ownership of nursing homes. The GAO later reported that the complexity of private investments in nursing homes suggested a need for improved ownership data. The GAO study on the quality of care by nursing homes owned by private investors yielded inconclusive results. There were no follow-up government studies, nor were there any coordinated congressional efforts to uncover the root of this problem. Our regulatory oculus had no point on which to fixate, and seemingly lacked the motivation to probe further.

And then the Pandemic happened.

Hindsight’s 20-20

Before the Pandemic, the American public had little information about the legal mechanisms sustaining and insulating this cycle of plunder and death. Now, this information is readily available thanks to research from altruistic legal scholars, dedicated journalists, and both last and least, a government study. What spurred this interest?

I will briefly table answering this question because, in order to understand why pre-pandemic information on how nursing homes became sites of systemic abuse was so sparse, it is important to understand what the PE-fund activities being insulated from public scrutiny are. I will therefore briefly summarize the relevant legal loopholes.

The PE Way: Maximize Debt, Minimize Cost

PE ownership of nursing homes breeds a nefarious healthcare environment because private equity acquisitions are typically funded with borrowed money, creating debt that is subsequently transferred onto nursing homes’ balance sheets. PE funds typically seek especially high rates of return and to exit their investments quickly. These goals incentivize them to take risky actions to boost short-term profits. PE funds sometimes sell off nursing homes’ property, saddling providers with lease payments. Investors may also charge providers exorbitant management fees. These types of actions impose layer upon layer of costs on nursing homes, potentially depriving them of the resources needed to properly care for residents.

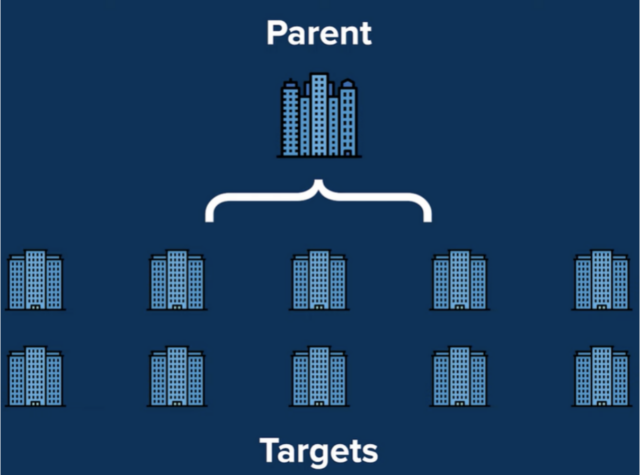

A PE investor fund buys nursing homes with debt. The PE minimizes expenses and maximizes cash flow with impunity, with cash going significantly to the PE and investors. How is this done? Through financial manipulation, made possible by hiding profit under the cover of financial obfuscation. At the heart of this process is (1) debt and (2) operating expenses.

PE loves debt because it is cheap and interest payments are tax deductible. This lets the PE make large acquisitions, and reduce taxable profit. But by loading up on debt, the PE needs to cut costs and extract as much value as possible to pay debt interest and generate the profits promised to investors. This limits reinvestment in the nursing home, with reductions in quality of care. The other profit-maximizing factor is operating expenses. Some states mandate that a substantial portion of profits be reinvested in the nursing home for resident care. For others this is at minimum an ethical obligation. However, financial tactics can reduce accounting profit – even to the point where a loss is declared. In this way the PE can avoid having to return profit to the enterprise, and instead siphon it off. Here are four tactics used to legally maximize cash flow while reducing declared profit:

- Sale-leasebacks: The PE firm sells acquired real estate (the nursing home) to another firm, and then leases back the property, in the process releasing an upfront pool of cash that is ideally invested in the enterprise but may be diverted to the PE and investors. This financial tool provides short-term gain at the expense of long-term investment.

- Dividend Recapitalization: The nursing home takes out a loan from the PE investment vehicle. Interest payments go directly to the PE firm. In effect the PE firm is diverting profit to itself as a cash dividend, courtesy of the nursing home interest payment.

- Fees: The PE fund levies fees on its homes for management, monitoring, transactions etc. Management fees can include everything from grounds and property maintenance to laundry and security services. Fees can be inflated above market rates and generate incremental profit for the PE and investors, all while reducing the net profit of the nursing home.

- Roll Ups: The investment company can use cheap debt and the financial leverage this affords to buy up a preponderance of nursing homes in a market, even leading to monopolistic share-of-market. This reduces competition, raises prices, reduces the incentive to enhance quality of care, and can fly under the radar of the FTC because of a lack of financial transparency requirements.

Source: PeakFramework post

While some regulatory standards guard against the above tactics, they are woefully outdated and have proven toothless. Federal staffing standards have not changed since 1987 and have been far below the levels in many PE-owned facilities. State standards are more stringent than federal mandated levels, so more nursing homes may have to respond to the state standards than to federal standards. However, in reality, raising minimum staffing standards involves substantial production costs (i.e., labor cost for additional staff, administrative cost to comply with standards), and in consequence, many facilities may rationally decide to operate below the minimum standards if the cost of meeting standards exceeds the cost of noncompliance. One study reported that 64 percent of nursing homes in California did not meet the mandatory standards in 2000, and 27 percent of facilities failed to comply by 2003. Furthermore, investors likely hedge against the probability of being caught – a rational bet given that a series of GAO reports expressed concern that the state survey process and enforcement activities were not being regularly enforced.

Federal staffing standards have not changed since 1987 and have been far below the levels in many PE-owned facilities.

The net result of PE fund acquisition is that PE funds and their investors take exorbitant profits and avoid adequate reinvestment in the homes because nursing home profits are understated. One representative analysis of a nursing home’s post-acquisition status revealed that by the time the fund sold the nursing home, lease payments back to the investor fund increased by 75 percent, increased interest payments on the home back to the fund by over 200 percent, and the home’s cash on hand decreased by almost 40 percent meaning less money for patient care. The reduction in care increased short-term mortality by 10 percent, and the probability of residents taking antipsychotic medication increased by 50 percent.

PE funds have acquired, drained and eventually dumped nursing homes in productive anonymity for decades. Then in 2021, at the height of the Pandemic, public scrutiny began to ebb at that anonymity.

What changed?

Follow the Money

Since the Pandemic, public health officials and politicians have increasingly scrutinized PE-owned nursing homes and the need for reform. While the Pandemic devastated the wellbeing of many nursing home staff and residents, the news articles, think tank-pieces and congressional initiatives railing against PE-nursing home care quality in particular were reacting to one common study on that topic, years in the making, by a group of public health experts at the Weil School of Public Health at Cornell.

One of the study’s principal authors discussed how this study was wrapping up at the start of the pandemic, and characterized the timing as “coincidental.” Dr. Mark Unruh and his team became interested in PE-owned nursing homes for one key reason: between 2010 and 2020 investment in these homes was skyrocketing.

Dr. Unruh followed the money. He and his team became interested in learning about how increased investment in funds acquiring nursing homes impacted patient care. Because regulators collected very little information on which PE funds owned nursing homes, Dr. Unruh and his team had to learn about the scope of this problem from scratch: “We had to create our own databases… We had to go and get [access to] proprietary databases that are usually used by Wall Street firms on mergers and acquisitions.” Dr. Unruh emphasized that this is a “very tedious process…it is very labor intensive to collect this data.”

At the time, no regulatory requirements forced PE funds to disclose the homes that they owned and how they managed them. Because PE funds frequently use complex corporate structures that make it difficult to identify related third parties, tracking the amount of revenue for staffing, services, and supplies that go to multiple related service providers appearing in Medicare and Medicaid databases as having ownership stakes in nursing homes is extremely difficult. Dr. Unruh’s study revealed what the above anecdotes attest to: that PE-owned nursing homes delivered a far lower quality of care than non-PE owned ones.

Source: PitchBook Catherine Kim/POLITICO

Two Bills, Two Responses

In response to increased concern about nursing home deaths, political capital pooled around two main policy responses. The first was The COVID-19 Nursing Home Protection Act. I will make three observations about this bill. First, it provided $750 million in federal funding which nursing home owners could directly use to mitigate staffing shortages and other areas of home-upkeep. Second, this bill did not mandate reporting of home ownership, nor did it raise minimum staffing level requirements. Third, all but three of the 18 sponsors and cosponsors of the bill were recipients of PE political contributions, many substantial, and three co-sponsors of the bill were on the top-ten list of senators who received the most annual funding from the PE-investment sector.

Had this bill been passed, PE nursing home owners could have used this new tranche of federal money in the same way they use Medicare and Medicaid: to reinvest in the fund’s health at the expense of its patients’ health. There would have been no guarantee the money would support patient care.

All but three of the 18 sponsors and cosponsors of the bill were recipients of PE political contributions.

The second political response was to rally behind the Quality Care for Nursing Home Residents and Workers During COVID–19 and Beyond Act. In contrast to the first bill, this bill did not provide discretionary funds for nursing homes. It proposed heightened minimum nursing staff levels, as well as mandated the type and amount of training those nurses would need to have. Additionally, this bill proposed increasing the type and amount of data that care homes must release, including more detailed information on which entities owned nursing homes receiving federal funds. None of this bill’s sponsors or cosponsors were reported as recipients of donations from the PE sector.

The PE sector vehemently decried this second bill. The American Health Care Association (ACHA – one lobbying arm of PE funds which own health facilities) argued that increased transparency about ownership structures would not benefit anybody: “[M]ore paperwork reporting will not drive quality. This has become a distraction from the real issues that impact the majority of providers, like Medicaid underfunding and workforce shortages.” The AHCA instead advised that policymakers should “prioritize investing in our caregivers and this chronically underfunded health care sector.” In other words: provide more government money for nursing home owners to spend, and less transparency regarding who those owners are.

![[F]law School Episode 9: Profits Over Patients](https://theflaw.org/wp-content/uploads/2024/12/danie-franco-CeZypKDceQc-unsplash-scaled-e1735518825718-640x427.jpg)