Keeping Consumers out of Court

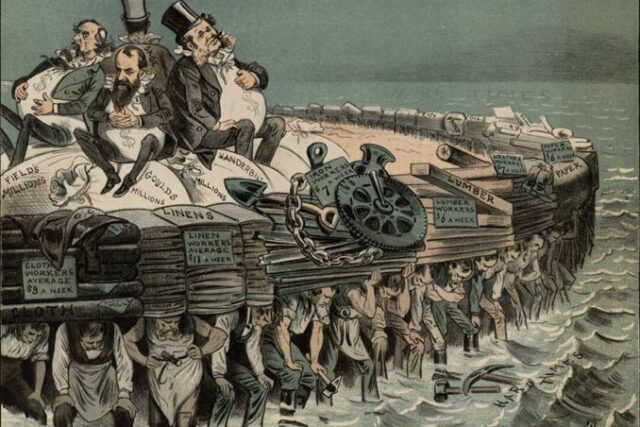

Corporations don’t have to win lawsuits if you can’t bring them in the first place.

Sarah Hart

May 5, 2024

In 2011, Sergio Ramirez went to a Nissan dealership to buy a car, accompanied by his family. After selecting the vehicle and deciding on the price, the salesperson, as part of the normal procedure, ran a credit check on Mr. Ramirez. Following the credit report, the salesperson refused to sell the vehicle, because according to the credit report prepared by Transunion, Mr. Ramirez was on a “terrorist list.” The credit report stated that he had been placed on the Department of the Treasury’s Office of Foreign Assets Control (OFAC) Specially Designated Nationals (SDNs) list.

The Department of the Treasury maintains this list to indicate to businesses which individuals are prevented from doing business in the United States for national security reasons. Transunion had issued the credit report using a third-party vendor whose software simply matched first and last names on the SDN list to borrowers, without any consideration for the fact that two individuals might have the same name. Furthermore, when instances arose like Mr. Ramirez’s, and consumers sought to have their information corrected, Transunion lied, telling them the issue had been resolved or failed to provide information to consumers on how to dispute or correct the information on their report. The Ninth Circuit held that not only did Transunion have the “capability to conduct more accurate searches,” Transunion was aware “this practice violated the [Fair Credit Reporting Act].”

Sergio Ramirez and 8,185 other people who were wrongfully designated as SDNs on their credit report sued Transunion in a class action under the Fair Credit Reporting Act (FCRA). The FCRA establishes rights for consumers such as the right to dispute inaccurate information in your credit report, and requires that reporting agencies ensure the information on the report is accurate. The Act also provides for damages related to any violations. When damages are outlined specifically in the statute, these are known as “statutory damages.” The class represented by Mr. Ramirez won their case at the district court. A jury awarded each class member $984.22 in statutory damages and $6,353.08 in punitive damages and the Ninth Circuit upheld the jury’s award of statutory damages. When the Supreme Court took up the case, they assumed for the purposes of the decision that Transunion had violated the law for all 8,185 members of the class. At every level, the judicial system found enough evidence to show or assume Transunion broke the law, but when the class reached the Supreme Court only 1,853 members of the class were able to assert their rights. The other 6,332 people were not protected by the law.

Why not?

Because of the judicial principle of standing. Generally, you cannot sue unless you were harmed directly. For example, if your neighbor is illegally downloading music, you cannot sue them for copyright infringement. The artist who released the song might be able to, but they are probably not aware of the illegal activity. Even though you may be the person most aware of the illegal action, your neighbor’s infringement did not harm you and so you cannot bring that harm to court. Even though a wrong happened, you cannot do anything to redress that harm. Who has the right to bring which wrongs to court is framed as a question of who has standing, the root of which comes from Article III of the Constitution.

For a party to have standing the party must have suffered (1) an “injury-in-fact,” (2) caused by the defendant, (3) that the court might be able to remedy.

Article III states that the “judicial power shall extend to all [c]ases, [and] [c]ontroversies.” This has been interpreted to mean that the federal courts will only decide “cases and controversies of the sort traditionally amenable to, and resolved by, the judicial process.” In the 20th century, the Supreme Court started to more clearly articulate what this meant in practice, finally articulating a “list” in Lujan v. Defenders of Wildlife. Here, the Court decided that for a party to have standing the party must have suffered (1) an “injury-in-fact,” (2) caused by the defendant, (3) that the court might be able to remedy.

Before 1970, the court generally found it was sufficient for standing if the plaintiff was protected by a statute that had been violated. If someone violated a statute that protected you, you could sue them, whether you could show you were specifically harmed by the law-breaking activity. You had a “statutory right” to be protected. But in 1970, the Court held that protection under a statute was not part of deciding whether there was standing. To sue in federal court, the party must have experienced an actual injury, a violation of the law alone does not give you the right to sue.

Why does this matter?

The FCRA along with the Fair Debt Collection Practices Act, the Truth in Lending Act, the Equal Credit Opportunity Act, and the Fair Housing Act (among others) include a statutory protection, giving individuals who are protected by the statute a right to sue on their own behalf – a private right of action – in order to enforce the statute. Unlike many of the nation’s laws which are designed to be enforced by the government alone, these laws can be enforced by either the government or individuals asserting their rights independently or as part of a group or class. Describing this phenomenon, Stuart Rossman, Director of Litigation at the National Consumer Law Center explained:

Congress and state legislatures recognized that federal and state governments would not have the capacity to enforce every violation of the consumer protection laws. Therefore, they provided private rights of action to supplement public enforcement. Individual consumers were empowered to represent themselves and to protect their own interests through consumer laws which also included explicit rights to pursue claims.”

These laws dramatically expanded the protections of consumers, especially in interactions with financial institutions, lending agencies, and credit reporting agencies.

Max Roberts, an Associate at Bursor & Fisher P.A., explained, “those private rights of action are very important tools for actually enforcing these laws. The federal government and the state governments have limited resources, and they can’t be pursuing every single possible violation of the law that has occurred.” The private rights of action, he added, are “important to not only the enforcement of these wrongs against a wider swath of companies, but as a deterrent to future misconduct.”

“The realistic alternative to a class action is not 17 million individual suits, but zero individual suits, as only a lunatic or a fanatic sues for $30.”

For this statutory scheme to work effectively however, it is beneficial for individuals to assert their rights as a class. In explaining why Stuart Rossman referred to Justice Breyer’s dissent in AT&T Mobility LLC v. Concepcion, 563 U.S. 333, 365 (2011). Citing Carnegie v. Household Intern., Inc., 376 F.3d 656, 661 (7th Cir. 2004), Justice Breyer stressed, “The realistic alternative to a class action is not 17 million individual suits, but zero individual suits, as only a lunatic or a fanatic sues for $30.” The lack of incentive to sue for a small amount means that the suits themselves disappear.

Class actions, therefore, are a very important method of enforcement of consumer protections. Class actions are organized around a few key representatives – named plaintiffs – who can illustrate the harm of the violation. The class itself, though, is a larger group whose harm would be evaluated individually at the end of the case when deciding who gets what remedy. Rather than each person bear the transaction costs of litigation, and adjudicate these claims individually, the class mechanism allows for key aspects of the case to be decided for a group providing a stronger incentive to enforce the law.

Traditionally, in consumer class actions, only the named plaintiff needed to have standing in order to decide key aspects of the case. Individual harm would be adjudicated later in the process when parties were assessing damages. But this class action standing formulation was fundamentally altered by the case of Mr. Ramirez, in Transunion v. Ramirez. The Supreme Court found that only 1,853 of the class members had standing to sue because their incorrect credit report had been disseminated to a third party, like what happened to Mr. Ramirez at the car dealership. Rather than deciding individualized harm at the end of the trial, the Court held that the approximately 6,000 people whose credit score was not disseminated to a third party cannot be part of the case from the beginning.

While Mr. Ramirez himself had standing, the majority of people who had been designated SDNs in Transunion credit reports were unable to sue Transunion. Stuart Rossman highlights the injustice of this decision. “The hubris of the Supreme Court to believe that a naturalized citizen or someone here [] on a green card [or other permit], would not suffer concrete harm by finding out that they were on a watch list. It’s absolutely ridiculous. You can almost take judicial notice of it.” This was not sufficient for the Court, however. The Court found that, even though Congress created the violation under the Fair Credit Reporting Act, and the Court assumed Transunion violated it, 6,000 people whose information was never shared could not enforce the law. The Courts decision said, “[o]nly those plaintiffs who have been concretely harmed by a defendant’s statutory violation may sue that private defendant over that violation in federal court.”

What harm is “concrete” enough to deserve judicial recognition feels arbitrary. Maybe, for some plaintiffs, the information was not disseminated, but is that an accurate formulation of harm? Congress established, when creating the private right of action, that enforcement of this law required people to be able to sue to assert their right to have an honest and fair evaluation of their credit. How we formulate harm related to violations of that law is as much a value judgment as it is a factual analysis. This limit on which harms the Court will address tells us which rights matter. Here, about 6,000 individuals who were protected by the FCRA had no remedy for Transunion’s violation, and with respect to those 6,000 people, Transunion went unpunished for misclassifying them as SDNs.