The prison-industrial complex perpetuates racial discrimination and injustice while hiding behind morally legitimating stories. Slavery too hid behind moral justifications. There, those justifications relied heavily on notions of black inferiority and racial difference. With the prison-industrial complex, although this system reanimates notions of racial hierarchy, it is also uniquely able to rely on an inherent sense of morality around criminality and punishment that was harder to justify with slavery.

The legitimating story for incarceration contains less mental leaps for people to make than slavery. Criminals deserve what they get. They committed a crime. They did something wrong. But with slavery the sin of Black people was simply being Black. That legitimating story is harder to justify than touting they are all locked up because they did something criminal. Instead of having to say Black people are inferior, you can say Black people are criminals. Criminals under this conception are other and subhuman. They are murderers, rapists, super predators.

By moving one step away from blackness itself, it is easier to remove oneself from questioning the morality of our prison system, helping alleviate the justice illusion for people. We tend to think of ourselves as good and just people; therefore, we don’t interrogate perceptions carefully in order to continue to align with that view of ourselves. I’m not racist, these people committed a crime, they should be in prison. This isn’t a racist system like slavery, white people go to prison too.

But at what rate? While the likelihood of imprisonment for Black men during their lifetime has decreased from a staggering 1 in 3 for those born in 1981 to a still disturbing 1 in 5 for Black men born in 2001, Black men are still four times as likely as white men to go to prison in their lifetime. 1 in 17 white men will go to prison in their lifetime. Black people make up 13% of the American population, yet they account for 37% of the prison population. Even so, this system is swallowing everyone whole.

Because our prison system is rooted in such a racist, all-consuming system as slavery, all people of color are disproportionately impacted, not just Black people. And white people are harmed too by the dispositional, enduring narrative of criminality. The shackling continues.

The Problem with Privatization

Because this direct line can be drawn from slavery to mass incarceration and imprisonment more broadly, privatization only further strengthens this through line.

For-profit imprisonment resurfaces and reimagines the business model of slavery.

For-profit prisons require bodies. They need labor from people who have not chosen to be imprisoned and cannot choose to leave that state of imprisonment.

Privatization in theory appeals to people because when the State says it will spend $100 a day taking care of an inmate and a private company comes in saying they can do the same for $75 a day, that sounds like a great deal to taxpayers. But what is the cost?

For-profit imprisonment resurfaces and reimagines the business model of slavery.

If prisons are supposedly premised on a model of rehabilitation, then they would be effective if the recidivism rate was 0%. Private prisons are a business first and foremost, so this rehabilitation model is entirely antithetical to their bottom line.

If private prisons were working to keep people from getting back in the system, they would be doing the work to put themselves out of business. This mission directly cuts against the goal of a corporation. Profit is the only goal.

Senator Ron Wyden of Oregon said in a statement that “Private prisons make our communities less safe by focusing on shareholder profits and doing nothing for rehabilitating people to become productive citizens after they have served their sentence.”

The rehab model for prisons is illegitimate, public or private, and completely incompatible with private prisons because rehabilitation is completely incompatible with the corporate structure. Prison is about punishment. Private prison is about profit. That is the only legitimate story to explain our prison system today. Looking right below the surface reveals the ugly truths about our prison system and the intentional framework put in place to continue enslaving people.

Privatizing prisons allows corporations to wield power we traditionally only hold for the State – the right to punish and govern that punishment. It is a logical outgrowth of the right to punish that that right includes the right to govern that punishment, and thus, conversely, that entities who are not the State do not, and should not, possess that power.

“Over the past 15 years, while the incarceration rate in the U.S. has grown, it has been outpaced by the growth in the number of people placed in private prisons.”

But privatization completely complicates that narrative. Private prisons give private actors a power we traditionally only entrust to the State. Our system is predicated on the State being the only entity even remotely legitimate to exercise this kind of power.

Prison abolitionists ask us to question whether that power to govern punishment is even legitimate for the State to possess. So if people are questioning the State’s legitimacy and reserve on punishing power, then how can we say that a private corporation legitimately can engage in this enterprise?

“Over the past 15 years, while the incarceration rate in the U.S. has grown, it has been outpaced by the growth in the number of people placed in private prisons.”

Going Public

Like other corporations, private prisons can go public, but the benefits they receive from becoming publicly traded differ in some ways from other corporations. When a company chooses to go public, typically they are doing so to increase access to capital and investors and to enhance their visibility. In the case of most businesses, exposure is the necessary factor for growth, but not with private prisons.

Private prisons need capital even more than these normal companies, and the stock market helps them fulfill that need. Public stock trading helps solve for the private prison business model’s innate problem – how much capital they have is directly linked to the number of bodies they have in the prison, so they need failsafe influxes of capital.

Slave auctions commodified human beings for profit. Investing in private prison stocks directly involves the same principle of profiting from the free labor of unfree people. For both, there is a financial incentive in maintaining a supply of commodities where those commodities are people, whether they are slaves or inmates, for the benefit of investors.

Source: GEO Group Inc.

There are two major publicly-traded private prisons, The GEO Group and CoreCivic. GEO Group and CoreCivic manage more than half of private prison contracts in the US.

We will focus in on GEO Group. The GEO Group began in 1984 as Wackenhut Corrections Corporation. This company primarily focused on security services. During the 1980s and 1990s Wackenhut Corrections Corporation expanded its reach by overseeing correctional facilities, including prisons, jails and detention centers mainly within the United States.

In 1994, Wackenhut Corrections Corporation went public by trading on the New York Stock Exchange under the symbol “WHC.” By 2003, the company rebranded itself from Wackenhut Corrections Corporation to The GEO Group Inc. and began focusing almost exclusively on corrections and less security related business. Over time, GEO Group has expanded its reach to immigration detention centers, private prisons, and mental health treatment facilities – they move in lockstep with our nation’s carceral expansion.

“Everyday people put their money in banks, banks lend that money out to the private prison industry, the private prison industry uses that financing for their day to day work including lobbying, which successfully funnels more detainees into their facilities, and banks reap a payoff from their loans.”

GEO Group primarily runs off of government contracts. The United States government, through the Department of Justice, awarded GEO Group $105 million in 2020 alone. Roughly 25% of GEO Group’s revenue comes from contracts with the Justice Department, which the Biden administration banned in early 2021, making GEO Group’s reliance on the stock market even greater.

On top of the government contracts, GEO Group receives lines of credit from Wall Street. Like any other company that banks give lines of credit to, GEO Group helps the banks by allowing them to make money from loan fees and interest as well as investments in the company itself.

A symbiotic relationship exists between the bank and GEO Group like with any corporation, but knowing the role the company plays in our carceral system makes this relationship deeply problematic. Why would we want banks to be able to fund or benefit from private prisons? The perennial question arises again – why are we in the business of profiting off of prisons anyways?

Also, by virtue of banks providing these lines of credit, as Forbes explains, bank customers are inextricably linked to private prisons.

“Everyday people put their money in banks, banks lend that money out to the private prison industry, the private prison industry uses that financing for their day to day work including lobbying, which successfully funnels more detainees into their facilities, and banks reap a payoff from their loans.”

And from there the modern slave auction continues to expand. Not only are people directly participating in the buying and trading of stocks in GEO Group, but by having your money in a bank at all, you are opened up to the possibility of participating in the funding of the private prison industry.

Political Influence — Turning Capital in Policy

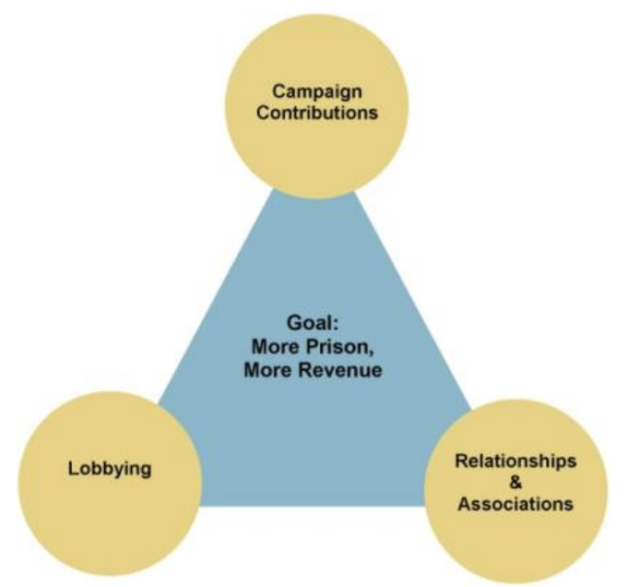

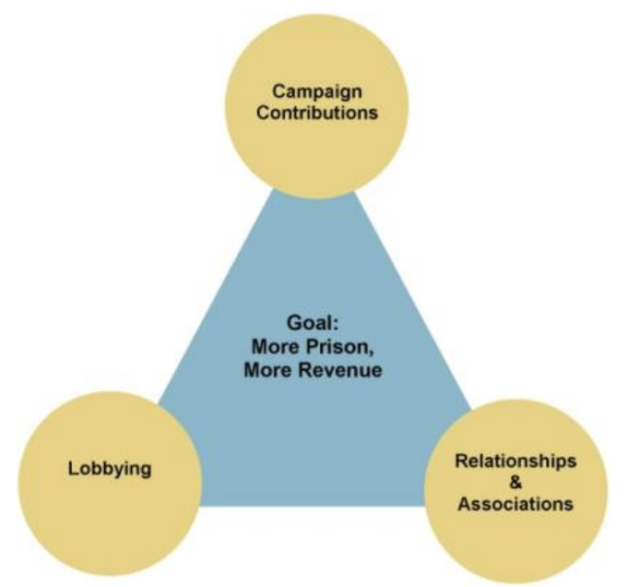

The GEO Group, like other large corporations, has wielded enormous political influence through building relationships and associations within government, lobbying, and campaign contributions.

Source: Justice Policy Institute

The Revolving Door: Relationship-Building

GEO provides board seats to former agency heads and former executives end up in agency positions themselves, thus creating a revolving door. GEO Group has benefited from it’s relationships with government officials as evidenced by appointments of former employees to key state and federal positions.

For example, numerous top ICE officials have left their posts at ICE to join GEO Group including Tracey Valerio, the former top official in charge of “all agency contracting,” Daniel Ragsdale, the deputy director of ICE, David Venturella, the former head of ICE’s Enforcement and Removal Operations, and Mary Loiselle, a former senior ICE official.

And the revolving door goes in the other direction. Ada Rivera, who was previously the director of Health Services at GEO Group, became the medical director of ICE’s Health Service Corps in 2017. Additionally, Frank Lara, the Federal Bureau of Prisons’ assistant director for correctional programs, announced his retirement from the bureau in 2018 and a few months later he landed at GEO Group as its director of operations and now he serves as regional vice president.

Lobbying and Campaign Contributions

The reason for-profit prisons work so hard to wield this political influence is because, as the Justice Policy Institute notes, “private prison contracts are written by state and federal policymakers and overseen by state and federal agency administrators, [so] it is in the best interest of private prison companies to build the connections needed to influence policies related to incarceration.”

One way the GEO Group uses their political voice is through political contributions. Per GEO’s annual Political Activity and Lobbying Report, GEO sponsors their own GEO PAC where “[c]orporate funds may be used to make political contributions where permitted by law.”

GEO’s political action committee funds across the aisle – GEO’s money goes to whatever political leaders will help push their agenda. In 2016, GEO PAC donated $252,405 to Republicans versus $35,940 to Democrats in 2016. In 2023, the PAC spent $362,000 in campaign contributions. GEO PAC makes contributions to both federal and state candidates.

“you can’t let subsidiaries get around what is illegal for the parent corporation to do, otherwise you just essentially throw out the law.”

The GEO Group also focuses heavily on lobbying. GEO directly lobbies legislators that support candidates who are sympathetic to their interests. For example, in 2023 GEO Group lobbied for eight federal bills relating to various issues surrounding immigration, carceral corrections, and national security.

In 2023, GEO spent $1.25M in lobbying efforts. Clearly by the growth in lobbying money, the stakes have been raised for GEO as public sentiment around private prisons has drastically declined. But a GEO Group spokesperson said in an email that the company “has never advocated for or against, nor have we ever played a role in setting criminal justice or immigration enforcement policies.”

Using Corporate Law as an Escape Hatch

GEO Group claims that it complies with all campaign finance laws and that no corporate funds are going directly to campaigns illegally. But that is not the whole story – GEO Group uses corporate law to find ways to circumvent campaign finance laws.

By setting up corporate subsidiaries, GEO Group has attempted to bypass campaign finance laws to fund the political campaigns and lobbyist groups that are anti-criminal justice reform. In August 2016, the Obama administration decided to stop contracting with for-profit private prisons. This decision made GEO Group’s stock price plummet. GEO responded by donating $100,000 to a super PAC aligned with then-presidential candidate Donald J. Trump.

Through their subsidiary called GEO Corrections Holdings, GEO Group, whose $2.33 billion in revenue was threatened by a potential Hilary Clinton administration that would have reinforced Obama’s policy, GEO gave an additional $125,000 a week until the election to “Rebuilding America Now,” a Trump-aligned super PAC chaired by Florida’s then-governor and now senator, Rick Scott.

The political moves GEO made had positive consequences on their stock price, government contracts, and agency connections. When Trump won, GEO Group stock rose 21% almost overnight. GEO Group then donated an additional $250,000 to Trump’s inauguration committee.

In February 2017, former Attorney General Jeff Sessions did away with the Obama policy and expanded private prison contracts with the federal government – the administration gave a $110 million, 10-year federal contract to GEO Group for ICE detention centers. Now, GEO Group is ICE’s largest contractor.

We should never see another google search full of articles about which prisons to invest in.

After this new contract, Campaign Legal Center filed a complaint in 2017 with the Federal Election Commission (FEC), alleging that GEO Group violated federal law prohibiting federal contractors from making political donations to influence federal law and policy for their advantage, These complaints have not stopped GEO. In 2023, GEO corporate subsidiaries spent $2,033,500 in political contributions.

Craig Holman from Public Citizen noted, “you can’t let subsidiaries get around what is illegal for the parent corporation to do, otherwise you just essentially throw out the law.”

GEO Group’s creation of shell companies demonstrates the manipulation of corporate law at its finest. Corporate law is a tool for corporations to hide behind and circumvent other laws like campaign finance laws. Corporate law here is both the shield and the sword.

The issues of corporate personhood and corporations in politics are only compounded by the fact that the corporation we speak of here is a private prison in the business of locking people in cages. Do we really need, or want, a company whose mission is to create a constant influx of incarcerated people possessing even a modicum of political influence over our laws, legislatures, and administrative state?

Ending Geo Group – Debanking and Unwinding the Narratives

GEO has experienced massive drops in capital, both from institutional and individual investors, making their political contributions all the more important. The debanking movement, made possible by grassroot activism in 2019, resulted in a massive divestment in the private prison industry and GEO Group.

Every bank providing credit and loans to GEO Group officially committed to cutting ties with the private prison industry in 2019. JPMorgan Chase, Wells Fargo, Bank of America, BNP Paribas, SunTrust, and Barclays are the banking partners who made this public announcement.

These banks agreed to not renew around $2.4B in credit lines to private prisons, creating a massive financing gap for GEO Group. This move presented an estimated shortfall of 87.4% of all credit to the industry, a devastating blow to GEO Group’s bottom line.

Source: Getty Images, photo by Joe Raedle

The debanking movement demonstrates just how powerful grassroots activism can be in creating pressure on huge institutional actors to reconsider their relationship with unethical corporate models through naming the practices and shaming their use and effects. This movement focused on organizing, coalition building, and raising awareness to mobilize public and private support for bank divestiture from private prisons. There is so much to learn from the debanking movement about tactics to engage stakeholders to make decisions that would change the landscape of prisons as we know it.

Debanking highlights the significant influence financial institutions have in shaping corporate behavior and investment decisions. Money doesn’t just talk, money screams. And the people that hold that money and choose where it goes have enormous power to shape the way the world looks.

Targeting banks is one means of disrupting the financial support systems that sustain private prisons. But because these prisons are publicly traded, there is still another source of capital that must be targeted, and GEO Group cannot be allowed to continue to access the market in this way.

What’s Next? Divesting, De-Indexing, and Delisting

Ending government contracting with private prisons and banks pulling their credit are huge steps in the right direction to end private prisons. These moves make GEO Group even more reliant on remaining in the stock market so they can access capital from investors.

But the public trading of private prisons must end. Something specifically must be done to end publicly-traded private prisons and cut off their access to the capital that the stock market provides. We should never see another google search full of articles about which prisons to invest in.

Source; Miami Herald/ Getty images, photo by Joe Raedle

First and foremost, divestment must continue from institutions and individuals. Vanguard and BlackRock are the two largest holders of GEO Group stock. These companies sit at the intersection of institutional and individual investment. Anyone who uses those platforms for their retirement plans and allows Vanguard’s or BlackRock’s online tools to choose their investments for them might hold GEO stock.

Many people only engage with the stock market through pension or retirement funds, so individual investors first need to learn about their exposure to private prisons in their own stock portfolios. But people can change what investments they allow in their Vanguard accounts. Individual investors can look at their portfolios and see if they are invested in GEO or CoreCivic stock by seeing what stocks their index funds contain. They can then switch their investments to other funds not containing GEO or CoreCivic.

People like the ease of letting these huge companies do all of the fund allocation and choices for them, but the lift here is worthwhile. A website that helps reduce this lift is prisonfreefunds.org where people can see what stocks tie them financially to private prisons.

Second, GEO Group and other corporations like it need to be de-indexed, helping alleviate some of the pressure on the first issue. In my interview with R. Andrew Free of Detention Kills, he explained that, “de-indexing exists in the framework of delisting as an intermediate step where the indices make the decision not to include companies like GEO Group in their index funds.” Because of the nature of passive investors who own a lot of this stock, this would have the effect of making it more difficult to invest in GEO Group.

Third, GEO Group needs to be delisted from the stock market. Delisting would come in the form of voluntary delisting by the company, regulatory delisting, or potentially bankruptcy.

Voluntary delisting is off the table because the board of GEO Group is completely disincentivized from passing that kind of resolution. Some shareholder activism could work there, but the shareholders want access to this capital as well.

Regulatory delisting is more promising. SEC Regulations could bar private prisons from even being able to be publicly traded. The SEC may initiate delisting proceedings if a company fails to meet listing requirements or violates securities laws. The listing requirements would need to be adapted to ensure that private prisons cannot be publicly traded.

The SEC is an independent agency that can promulgate rules making it so the requirements for listing do not align with private prisons. Then, GEO Group and other private prisons that are already public would then need to be delisted and no other private prisons could become publicly traded.

If a person’s incarceration in a GEO Group prison is about punishment, or rehabilitation, or repaying your debt to society, does that debt to society include enriching the shareholders of a private company?

Given the revolving door of GEO Group executives in administrative state positions, and vice versa, this deep capture makes regulatory delisting an uphill battle and would require real organizing from outside forces to incentivize agencies like the SEC who control the stock market and securities regulation to take this step.

To create the incentives for de-indexing and regulatory delisting, our existing laws could frame the conversation and reshape the narrative around publicly traded private prisons. The seeds of banning private prisons from listing on the stock market already exist in the form of implementations of the Trafficking Victims Protection Act (TVPA).

Under the TVPA, no person or corporation is supposed to be able to profit from forced labor, sex trafficking, or human trafficking, knowingly or directly. And that is true both as a matter of federal criminal law and a matter of contract law.

We can then imagine an index fund or the stock market saying if you are in violation of the TVPA, which these private prisons are, then you should not be traded. This could be posed in terms of market and investor protection – it is a matter of ensuring that investors who have imperfect information about the business are not into thinking this company has great margins based on the regular economics of other companies when GEO Group is really working off of free labor.

A new SEC regulation certification requirement in line with the TVPA could be a powerful step forward. This requirement would have to span broader than prisons to be palatable, it would be a general commitment to disallow public capital market profit making off of bondage in any industry.

The demand to the SEC and index funds if posed in the right way would be let’s not make the stock market a place where we turn a blind eye to slavery. The TVPA prevents forced labor, so why would GEO Group be able to trade if their entire business model is based on just that?

This organizing effort involves naming and shaming what is really happening here as well as coalition building with the anti-trafficking community. Both of these tactics proved successful in the debanking movement which has shown us the tools for a divesting, de-indexing and delisting effort.

![[F]law School Episode 10: Mass Incarceration, Inc.](https://theflaw.org/wp-content/uploads/2025/01/RICHARDS_PHOTO_Protest2-640x427.png)